Cutting tools are at the heart of modern manufacturing. From aerospace and automotive to medical devices and electronics, every precision component begins with a tool designed to cut, mill, drill, or shape raw material into a finished product. The global cutting tool industry has evolved over the past century, with manufacturers constantly innovating in carbide, ceramics, coatings, and geometries to improve productivity, accuracy, and tool life.

Today, manufacturers rely on established leaders such as Sandvik Coromant, Kennametal, ISCAR, Mitsubishi Materials, Kyocera, and others, along with specialized players like Union Tool, Horn USA, and Vargus, each bringing unique strengths to the market. Choosing the right partner can impact efficiency, cost savings, and part quality directly.

In this blog, we’ll deeply dive into the world’s top cutting tool manufacturers in 2025, exploring their history, product portfolios, innovations, and what makes them stand out. You’ll also find an industry overview, comparison tables, and practical tips to help you select the right toolmaker.

Key Takeaways

- The global cutting tool market is driven by demand from aerospace, automotive, energy, and precision engineering industries.

- Sandvik Coromant, Kennametal, ISCAR, Mitsubishi Materials, Kyocera, and Seco Tools are recognized as global full-line leaders.

- Specialized players like Union Tool, Horn USA, and Vargus focus on niche areas such as PCB milling, grooving, and threading.

- Most leading manufacturers are headquartered in Japan, Germany, the USA, and Sweden, highlighting their dominance in precision engineering.

- Innovations in carbide, PCD/CBN coatings (TiAlN, AlTiN, DLC), and digital tool management continue to shape the industry.

- Selecting the right cutting tool manufacturer depends on factors like material being machined, tool life, availability, after-sales support, and cost efficiency.

- Strategic partnerships and acquisitions (e.g., IMC Group’s consolidation of ISCAR, Tungaloy, and Ingersoll) have reshaped the competitive landscape.

- Manufacturers increasingly focus on smart manufacturing, sustainability, and Industry 4.0 integration to support modern factories.

Global Cutting Tool Industry Overview (2025)

The global cutting tool industry in 2025 is experiencing one of its most dynamic growth phases, fueled by innovation in materials, Industry 4.0 technologies, and expanding manufacturing demand across key sectors such as automotive, aerospace, construction, and renewable energy.

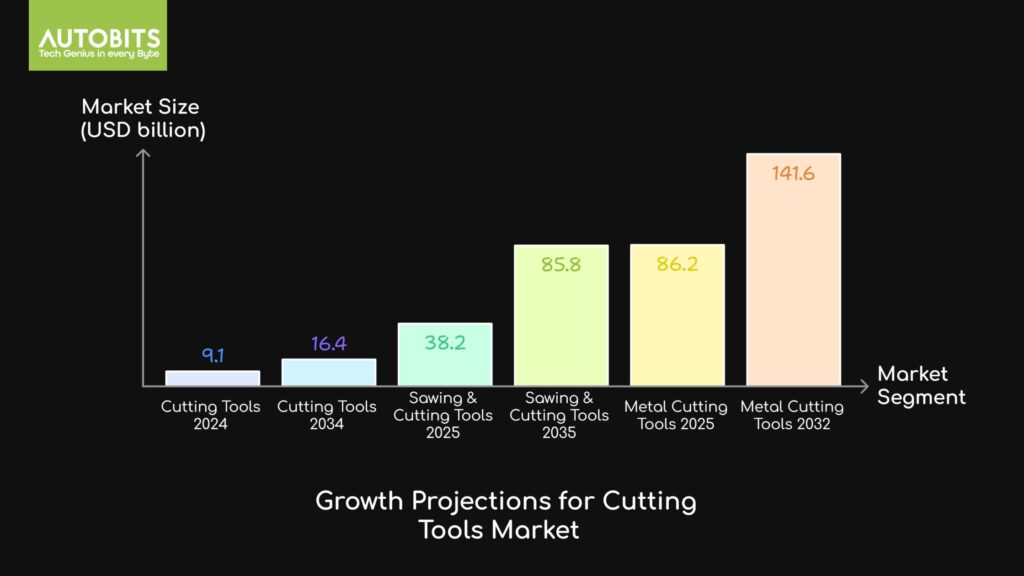

Market Size and Growth

- The cutting tools market was valued at USD 9.1 billion in 2024 and is projected to reach USD 16.4 billion by 2034, growing at a CAGR of 6.1%.

- The broader sawing and cutting tools market is significantly larger, estimated at USD 38.2 billion in 2025, with projections of USD 85.8 billion by 2035 at an 8.4% CAGR.

- The metal cutting tools segment alone is forecasted to expand from USD 86.2 billion in 2025 to USD 141.6 billion by 2032.

- Asia Pacific continues to dominate, holding over 50% global market share, with China, Japan, and India driving growth due to large-scale industrialization and government investments in advanced manufacturing.

Key Industry Trends

- Advanced Materials and Coatings

- Leading manufacturers are investing in carbide, ceramic, cubic boron nitride (CBN), and polycrystalline diamond (PCD) tools.

- Nano-coatings such as TiAlN, AlTiN, and DLC significantly improve wear resistance, heat dissipation, and tool life, making them indispensable in high-speed and dry machining.

- Automation and Digitalization

- Integration with Industry 4.0 and IoT creates innovative cutting tools capable of transmitting performance data in real-time.

- Factories now use predictive maintenance systems to reduce downtime and extend tool lifespan.

- AI and Machine Learning in Machining

- Intelligent tools now self-analyze cutting conditions, adjust parameters, and enable adaptive machining.

- This helps manufacturers minimize tool breakage and achieve higher precision in complex parts.

- Sustainability and Green Manufacturing

- Companies are focusing on energy-efficient processes and tools made from eco-friendly materials.

- Recycling and regrinding programs are expanding to reduce material waste.

- Customization and High-Precision Demands

- Aerospace and defense industries require complex, high-tolerance components, driving demand for specialized tools.

- Automotive OEMs are pushing for lightweight solutions for EVs, requiring custom cutting tools for composites, titanium, and aluminum alloys.

Sector Demand and Growth Drivers

- Automotive & Aerospace → EV adoption and composite materials drive new tool designs.

- Construction & Infrastructure → Global urbanization increases demand for durable concrete, steel, and composite cutting tools.

- Renewable Energy → Wind turbine components and solar panel frames require specialized, high-strength cutting tools.

- Emerging Economies → India, Vietnam, and Indonesia invest heavily in manufacturing capacity, creating new opportunities for tool suppliers.

Regional Insights

- Asia Pacific → Holds the most significant share with strong demand from China, Japan, and India.

- North America → Growth driven by aerospace, defense, and EV manufacturing hubs in the US and Mexico.

- Europe → Germany, Italy, and Switzerland remain leaders in precision engineering and advanced toolmaking.

- Middle East & Africa → Emerging demand in construction and oil & gas.

Competitive and Technology Outlook

The industry remains highly competitive, with global leaders like Sandvik Coromant, ISCAR, and Kennametal competing alongside regional specialists such as Union Tool and Horn USA.

- R&D spending is focused on new tool geometries, ultra-hard coatings, and digital machining solutions.

- Partnerships between toolmakers and CNC software providers enable seamless integration with innovative factory ecosystems.

- The future points toward a convergence of precision cutting, digital monitoring, and sustainable production.

In summary, the cutting tool industry 2025 is marked by robust growth, rapid technological evolution, and an increasing emphasis on intelligent, sustainable, and high-performance tooling solutions across all major manufacturing sectors.

Major Cutting Tool Manufacturers (Full-Line Providers)

These companies are considered full-line cutting tool providers, meaning they offer a broad portfolio of tools covering almost every machining need; from turning and milling to drilling, threading, and advanced tooling for aerospace and automotive applications.

1. Sandvik Coromant

Overview & History

- Founded in 1862 (parent company Sandvik AB in Sweden).

- Headquarters: Sandviken, Sweden.

- Global Presence: Operations in 150+ countries, manufacturing units, and R&D centers worldwide.

- Sandvik Coromant is the largest cutting tool manufacturer globally and is widely regarded as the leader in metal cutting innovation.

Product Portfolio

- Turning: Carbide inserts, cermet, ceramics, and PCBN inserts.

- Milling: Solid carbide end mills, indexable milling cutters, face mills.

- Drilling: Solid carbide drills, indexable drills, modular drill systems.

- Threading: Thread milling, tapping, and thread turning tools.

- Tooling Systems: Quick-change toolholding (e.g., Coromant Capto®).

Key Innovations

- Coromant Capto® Toolholding System: ISO standard for modular quick-change tooling.

- Silent Tools™: Advanced dampened tool holders for vibration-free machining.

- CoroCut® QD: Grooving and parting-off solution with optimized rigidity.

- Digital Machining Solutions: Connected tools with real-time cutting data and tool life monitoring.

Industry Strengths

- Market leader in R&D and patents for cutting technology.

- Strong presence in aerospace, automotive, and energy sectors.

- Pioneered sustainable manufacturing initiatives with recycled carbide tools.

2. Kennametal

Overview & History

- Founded in 1938 by Philip M. McKenna.

- Headquarters: Pittsburgh, Pennsylvania, USA.

- Global Presence: Active in 60+ countries, with strong markets in North America, Europe, and Asia.

- Known for combining material science expertise with tool design.

Product Portfolio

- Turning: Carbide, ceramic, and CBN inserts.

- Milling: Face mills, shoulder mills, high-performance end mills.

- Drilling: Modular drilling systems, indexable insert drills.

- Toolholding: Hydraulic chucks, shrink-fit systems.

- Other Products: Wear-resistant solutions for mining, energy, and aerospace.

Key Innovations

- HARVI™ End Mills: Known for high metal removal rates in aerospace alloys.

- KM™ Quick-Change Tooling System: High-precision, modular tooling.

- KenTIP™ FS Modular Drill System: Replaceable tip drilling technology.

- Additive Manufacturing: Pioneering in 3D-printed tungsten carbide tools.

Industry Strengths

- Strong in aerospace (Boeing, Airbus suppliers), automotive, and energy sectors.

- Known for durability in harsh machining environments.

- Diversified portfolio beyond cutting tools (mining, wear parts).

3. ISCAR (IMC Group, part of Berkshire Hathaway)

Overview & History

- Founded in 1952 by Stef Wertheimer.

- Headquarters: Tefen Industrial Zone, Israel.

- Ownership: Part of the IMC Group, acquired by Berkshire Hathaway (Warren Buffett) in 2006.

- Recognized for its innovative designs and aggressive market growth.

Product Portfolio

- Turning: Indexable carbide inserts, parting & grooving tools.

- Milling: High-efficiency indexable mills, solid carbide cutters.

- Drilling: Chamdrill® line with replaceable heads.

- Threading: Thread milling and turning tools.

- Toolholding: Advanced modular systems.

Key Innovations

- IQ Cloud™ and IQ Cloud+™: Smart machining cloud-based platforms.

- SUMO TEC® Coating Technology: Enhanced wear resistance and tool life.

- LOGIQ Series: High-performance tools for productivity improvement.

- HELI2000 Milling Cutters: Known for efficiency in aerospace alloys.

Industry Strengths

- Extremely strong in automotive and aerospace machining.

- Aggressive global expansion through IMC Group subsidiaries.

- Focused on modular, cost-efficient tooling solutions.

4. Walter Tools (Part of Sandvik Group)

Overview & History

- Founded in 1919 by Richard Walter in Tübingen, Germany.

- Headquarters: Tübingen, Germany.

- Ownership: Subsidiary of Sandvik Group since 2002.

- Known as a high-end cutting tool manufacturer with a premium engineering focus.

Product Portfolio

- Turning: Carbide inserts, CBN, ceramic, and cermet.

- Milling: Indexable milling cutters, solid carbide end mills.

- Drilling: Solid carbide drills, indexable insert drills.

- Threading: Thread milling and turning tools.

- Tool Management Solutions: Walter Tool-ID and Walter GPS software.

Key Innovations

- Walter Multiply: Service package for digital manufacturing solutions.

- Walter GPS: Tool selection and application recommendation software.

- Tiger·tec® Gold: Premium coating for carbide inserts with extended tool life.

Industry Strengths

- Very strong in aerospace, die & mold, and precision machining.

- Known for process optimization services in addition to tools.

5. Mitsubishi Materials

Overview & History

- Parent Company: Mitsubishi Materials Corporation, Japan.

- Global Presence: Strong in Asia, North America, and Europe.

- Offers a broad spectrum of cutting tools with Japanese precision.

Product Portfolio

- Turning: Carbide inserts, CBN, ceramics.

- Milling: Solid carbide and indexable mills.

- Drilling: MVS series solid carbide drills and replaceable-head drills.

- Threading: Thread milling cutters and taps.

- Toolholding: Precision modular systems.

Key Innovations

- Smart Miracle End Mills: Coated tools for high-speed machining.

- iMX Exchangeable Head End Mills: Unique modular system.

- DU series solid carbide drills: Known for productivity in steels.

Industry Strengths

- Leader in precision machining for automotive and electronics.

- Strong focus on sustainability and advanced coatings.

6. Seco Tools (Sandvik Group)

Overview & History

- Founded: 1932 in Fagersta, Sweden.

- Headquarters: Fagersta, Sweden.

- Ownership: Subsidiary of Sandvik AB.

- Known for being a customer-focused, mid-premium brand.

Product Portfolio

- Turning: A wide range of carbide inserts is needed.

- Milling: Indexable cutters, solid carbide end mills.

- Drilling: Perfomax indexable drills, solid carbide drills.

- Threading: Thread turning and milling.

- Toolholding: Steadyline® damped milling tools.

Key Innovations

- Steadyline®: Anti-vibration milling toolholders.

- Perfomax Drills: High-productivity indexable insert drills.

- Duratomic® Coating: Advanced wear-resistant technology.

Industry Strengths

- Strong in general engineering and aerospace.

- Known for global training and application support.

7. Sumitomo Electric Hardmetal

Overview & History

- Parent Company: Sumitomo Electric Industries, Japan.

- Founded: 1909.

- Specializes in superhard cutting materials.

Product Portfolio

- Turning: PCBN, PCD, carbide inserts.

- Milling: Solid carbide end mills, PCD tools.

- Drilling: Solid carbide drills, PCD-tipped drills.

- Threading: Thread turning solutions.

Key Innovations

- SUMIBORON® (PCBN Inserts): For hardened steels.

- SUMIDIA® (PCD Tools): For non-ferrous and composite machining.

- Breakthrough in Nanocrystalline Diamond Tools.

Industry Strengths

- Global leader in hard material machining (automotive, aerospace).

- Strong in electric vehicle components and lightweight alloys.

8. Tungaloy (IMC Group / Berkshire Hathaway)

Overview & History

- Founded: 1929, Japan.

- Ownership: Member of IMC Group (Berkshire Hathaway).

- Known for aggressive innovation and rapid product launches.

Product Portfolio

- Turning: Carbide and CBN inserts.

- Milling: Indexable milling cutters, high-feed mills.

- Drilling: Exchangeable head drills, solid carbide drills.

- Threading: Thread turning tools.

Key Innovations

- AddForce and DoFeed Milling Systems: Popular in aerospace and automotive.

- MillQuadCutters: For precision mold and die applications.

- Tungaloy Machining Cloud™: Digital machining optimization tool.

Industry Strengths

- Strong in the automotive and die/mold industries.

- Rapid R&D-to-market cycle.

9. Kyocera Cutting Tools

Overview & History

- Parent Company: Kyocera Corporation, Japan.

- Founded: 1959.

- Strong presence in Asia, North America, and Europe.

Product Portfolio

- Turning: Ceramic, carbide, and CBN inserts.

- Milling: Indexable and solid carbide cutters.

- Drilling: Solid carbide drills, replaceable tip drills.

- Other: High-precision toolholding.

Key Innovations

- MEGACOAT NANO Coating: Industry-leading wear resistance.

- MFH-Raptor High-Feed Milling Cutters.

- Ceramic Tools for Heat-Resistant Alloys.

Industry Strengths

- Strong in aerospace alloys and automotive machining.

- Known for advanced ceramic tooling solutions.

10. Dormer Pramet

Overview & History

- Headquarters: Sweden (Dormer) and the Czech Republic (Pramet).

- Ownership: Part of Sandvik Group.

- Known for offering reliable, cost-efficient cutting tools.

Product Portfolio

- Turning: Indexable inserts (Pramet).

- Milling: Solid carbide end mills (Dormer) and indexable cutters.

- Drilling: Dormer’s HSS and solid carbide drills.

- Threading: Taps, thread mills.

Key Innovations

- Pramet indexable solutions for steels.

- Dormer branded solid round tools.

Industry Strengths

- Preferred in general machining, small workshops, and cost-sensitive markets.

11. OSG Corporation

Overview & History

- Founded in 1938 in Japan.

- Headquarters: Tokyo, Japan.

- Specialized in taps, end mills, drills, and thread tools.

Product Portfolio

- Threading: Industry leader in taps and thread mills.

- Drilling: Solid carbide drills, indexable drills.

- Milling: Solid carbide and HSS end mills.

Key Innovations

- A Brand® Taps and Drills: Recognized globally.

- EXOPRO® End Mills: High-performance tool line.

Industry Strengths

- #1 in thread cutting tools.

- Strong in general machining, automotive, and aerospace.

12. Mapal

Overview & History

- Founded: 1950, Aalen, Germany.

- Headquarters: Aalen, Germany.

- Specialized in precision tooling and reamers.

Product Portfolio

- Turning/Milling: Limited focus.

- Drilling/Reaming: Highly specialized reaming tools.

- Boring Systems: World leader in fine boring tools.

Key Innovations

- MAPAL HPR High-Performance Reamers.

- Digital Tool Management Systems.

Industry Strengths

- Strong in automotive engine, transmission, and aerospace precision machining.

13. Gühring

Overview & History

- Founded: 1898, Germany.

- Headquarters: Albstadt, Germany.

- One of the largest producers of round solid carbide tools.

Product Portfolio

- Drilling: HSS, carbide, PCD drills.

- Milling: Solid carbide end mills.

- Threading: Taps, thread mills.

Key Innovations

- RT 100 Drill Series.

- Tool Management Systems.

Industry Strengths

- Strong in solid carbide drills and end mills.

- Known for German engineering precision.

14. YG-1

Overview & History

- Founded: 1981, South Korea.

- Headquarters: Incheon, South Korea.

- Largest Korean cutting tool manufacturer.

Product Portfolio

- Drilling: Solid carbide and HSS drills.

- Milling: Carbide and HSS end mills.

- Threading: Taps and thread mills.

Key Innovations

- Dream Drills (carbide drilling line).

- X5070 carbide end mills for hardened steels.

Industry Strengths

- Popular in cost-competitive tooling markets.

- Strong global distribution network.

15. TaeguTec (IMC Group)

Overview & History

- Founded: 1952, South Korea.

- Ownership: Part of IMC Group (Berkshire Hathaway).

- Known for a comprehensive cutting tool portfolio.

Product Portfolio

- Turning: Carbide inserts, CBN tools.

- Milling: Indexable milling systems.

- Drilling: Replaceable head and solid carbide drills.

Key Innovations

- Mill Rush Line: For high-speed machining.

- Chase Drill Systems.

Industry Strengths

- Strong in general machining, automotive, and die/mold.

16. BIG Daishowa (BIG Kaiser)

Overview & History

- Founded: 1967, Japan (Daishowa Seiki).

- Subsidiary: BIG Kaiser (USA).

- Known as a tooling systems and precision boring specialist.

Product Portfolio

- Boring Tools: Precision fine boring systems.

- Toolholding: Shrink fit, hydraulic chucks.

- Cutting Tools: Solid carbide drills, end mills.

Key Innovations

- BIG-PLUS Spindle System.

- Digital Boring Heads.

Industry Strengths

- World leader in boring and toolholding systems.

17. NTK Cutting Tools (NGK Spark Plug Group)

Overview & History

- Parent Company: NGK Spark Plug Co., Japan.

- Specialized in ceramic cutting tools.

Product Portfolio

- Turning: Ceramic, CBN, and carbide inserts.

- Grooving and Parting: Specialty tools.

Key Innovations

- SiAlON Ceramic Inserts: For heat-resistant alloys.

- NTK BIDEMICS: Advanced ceramic material with extreme heat resistance.

Industry Strengths

- Leader in ceramic tooling for aerospace and nickel-based alloys.

Specialized / Niche Cutting Tool Manufacturers

While “full-line” brands cover most operations, these specialists dominate narrow, high-value categories such as threading, precision grooving, micro tooling, ceramics, and PCB drills.

18. Vargus (Israel) — Threading & Grooving Specialist

Why they’re notable: Vargus has three core product families: VARDEX (thread turning & thread milling, including gear milling), GROOVEX (grooving/parting), and SHAVIV (hand deburring). Their VARGUS GENius is an intelligent tool selector and CNC program generator used widely for threading applications. Vargus belongs to the privately held NEUMO Ehrenberg Group. vargus.com+3vargus.com+3vargus.com+3

Sweet spot use cases:

- “Best thread milling tools for stainless steel”

- High-mix, low-volume shops needing fast CNC code for unusual thread forms

- Gear, rack, and spline milling where VARDEX offers indexable and solid options. vargus.com

19. DIJET Industrial (Japan) — High-Feed Milling & Tough Carbide

Why they’re notable: DIJET manufactures its own carbide and focuses on high-precision, high-efficiency indexable tooling (notably high-feed and shoulder milling), solid carbide end mills, and drills. Strong adoption in mold & die, aerospace finishing, and high-feed roughing. dijet-tool.com+1Dijet USA –

Sweet spot use cases:

- “High-feed milling cutters for hardened steel”

- “Stable shoulder milling tools with high rigidity” dijet-tool.com

20. Paul Horn GmbH / Horn USA (Germany/USA) — Precision Grooving, Micro Machining

They’re notable: Paul Horn pioneered many precision grooving and small-part systems (e.g., Supermini®, System 117) and now offers advanced solutions for broaching, drilling (including PCD/CVD-D), and milling. Horn emphasizes rapid custom specials (HORN Solutions Plus) and hosts well-known “Technology Days.” US operations are in Franklin, Tennessee. horn-group.com+3horn-group.com+3horn-group.com+3

Sweet spot use cases:

- “Best tools for precision internal grooving at small diameters”

- “PCD/CVD-D tools for non-ferrous micro drilling” horn-group.com

21. Union Tool (Japan) — PCB Micro Drills & Fine End Mills

Why they’re notable: A global leader in PCB micro drills/routers and carbide end mills (UNIMAX series), with deep vertical integration and proprietary metrology. Heavily used in electronics and semiconductor supply chains. Union Tool+2Union Tool+2.

Sweet spot use cases:

- “Best PCB micro drills for high-layer count boards”

- “Ultra-small carbide end mills ≤12 mm for precision machining”

Comparison Table of Cutting Tool Manufacturers

| Manufacturer | HQ / Region | Ownership / Group | Core Portfolio | Strengths / USPs |

|---|---|---|---|---|

| Sandvik Coromant | Sweden | Sandvik | Indexables, solid round, tooling systems | R&D depth; PrimeTurning/modern geometries; global tech centers. (Sandvik Coromant) |

| Kennametal | USA | Public | Indexables, round tools, wear | Broad industrial coverage; materials science heritage. (Kennametal) |

| ISCAR | Israel | IMC (Berkshire Hathaway) | Indexables, modular milling/turning | Ingenious insert families; strong on multi-axis milling. (Berkshire Hathaway) |

| Walter (incl. KOMET) | Germany | Sandvik | Indexables, KOMET holemaking | High-end holemaking & indexable milling. (Sandvik Group) |

| Mitsubishi Materials | Japan | Mitsubishi Materials | Turning, milling, drilling, CBN/CBN | Automotive & mold leads, strong grades. (MITSUBISHI MATERIALS CORPORATION) |

| Seco Tools | Sweden | Sandvik | Full line | Application support; aerospace/medical. (secotools.com) |

| Sumitomo Electric | Japan | Sumitomo Electric | Turning, milling, drilling, CBN/PCD | Superhard tooling expertise. (sumitool.com) |

| Tungaloy | Japan | IMC | Full line | Versatile turning/milling families. (Tungaloy Corporation) |

| Kyocera | Japan | Kyocera | Indexables, round, ceramics | Wide grade portfolio; industrial scale. (KYOCERA Precision Tools) |

| Dormer Pramet | UK/Czech | Sandvik | Solid round (Dormer), indexables (Pramet) | Practical, value-focused global range. (dormerpramet.com) |

| OSG | Japan | OSG Corp. | Taps, end mills, drills | World leader in threading tools. (osgtool.com) |

| MAPAL | Germany | MAPAL Group | Holemaking, clamping, PCD | Boring/reaming & customized solutions. (mapal.com) |

| Guhring | Germany | Gühring KG | Solid round tools, holders | In-house carbide; huge catalog depth. (Gühring KG, guhring.com) |

| YG-1 | Korea | YG-1 | Solid round & indexables | Strong price-performance; broad SKUs. (YG-1, YG1 Brand) |

| TaeguTec | Korea | IMC | Full line + tungsten products | Global network; IMC synergies. (taegutec.com) |

| BIG DAISHOWA (BIG KAISER) | Japan/CH/USA | BIG Daishowa | Tool holders, boring, presetters | High-precision HSK/CAT/BT holders; modular boring. Rebrand from BIG KAISER in 2022. (BIG DAISHOWA—Americas) |

| NTK Cutting Tools | Japan | IMC (51%) / Niterra (49%) JV | Ceramic/CBN turning, Swiss tooling | Premier ceramics; formal IMC member as of Apr 3, 2023. (niterragroup.com, MarketScreener, Megatech Thailand) |

| Ingersoll Cutting Tools | USA | IMC | Milling, holemaking, specials | Heavy-duty milling; project engineering. (ingersoll-imc.com) |

| CERATIZIT Group | Luxembourg | Plansee Group | Full line + hard materials | Acquired KOMET Group (2017); strong carbide supply chain (incl. CB-CERATIZIT in Asia). (ceratizit.com, Cision News, cbceratizit.com) |

| Vargus | Israel | NEUMO Ehrenberg Group | Threading, grooving, deburring | VARDEX threading & GENius software. (vargus.com) |

| DIJET Industrial | Japan | DIJET | Indexables, solids, carbide | High-feed specialists; own carbide. (dijet-tool.com) |

| Paul Horn / Horn USA | Germany/USA | Paul Horn GmbH | Precision grooving, micro machining | Supermini®, fast specials; US base in Franklin, TN. (horn-group.com) |

| Union Tool | Japan | Union Tool | PCB drills/routers, fine end mills | Electronics/PCB leader; UNIMAX end mills. (Union Tool) |

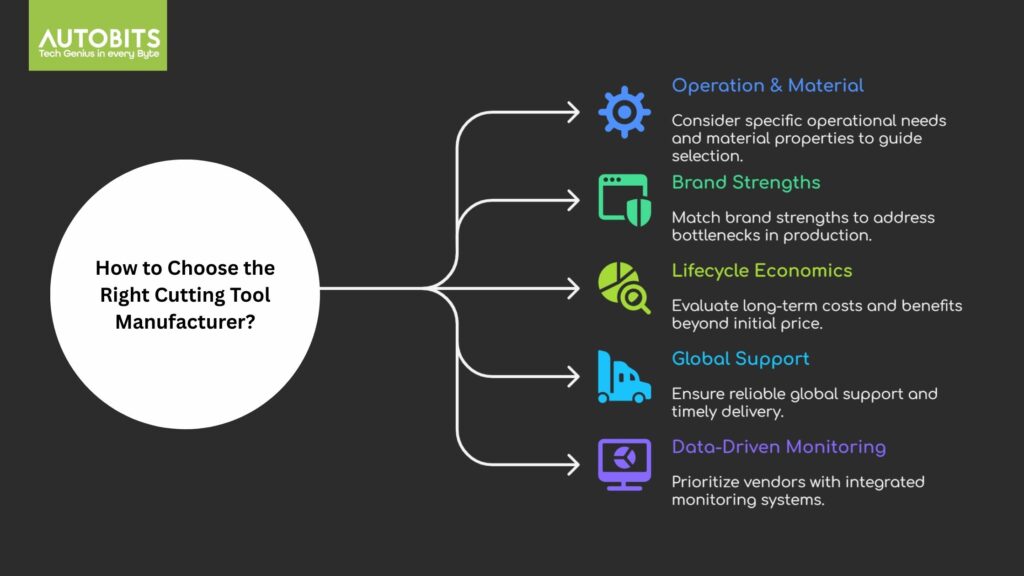

How to Choose the Right Cutting Tool Manufacturer? (Step-by-step)

Start from the operation & material (not the catalog).

Long-tail intent queries to consider:

- best indexable milling system for Inconel 718 aerospace brackets

- CBN turning inserts for hard turning 60 HRC bearing steel

- thread milling vs thread turning for thin-walled titanium tubes

Match brand strengths to your bottleneck.

- Threading/grooving with complex standards → Vargus (VARDEX), Horn. vargus.comhorn-group.com

- High-feed/shoulder milling productivity → DIJET, Ingersoll, Iscar. dijet-tool.comingersoll-imc.com

- Holemaking/boring precision → Walter/KOMET, MAPAL. Sandvik Groupmapal.com

- Tool holding & boring heads → BIG DAISHOWA. BIG DAISHOWA—Americas

- Ceramic/CBN hard turning → NTK, Sumitomo. niterragroup.com

- PCB drills & micro tools → Union Tool. Union Tool

Evaluate lifecycle economics, not just insert price.

Ask for application trials, tool life and cycle time deltas, reconditioning options, coating services, and tool-management software or vending.

Verify global support & lead times.

Aerospace/medical often require local tech centers, ISO docs, PPAP, and fast specials (e.g., Horn’s rapid custom workflow). horn-group.com

Prioritize data-driven monitoring.

Choose vendors whose tools integrate with your machine-monitoring and tool-life systems (see the section below on Autobits Lab for a pragmatic approach).

Decision matrix to copy into RFQs:

- Material(s) & hardness ranges

- Operation type + machine model/spindle/toolholder interface

- Tolerance/surface finish specs

- Current cycle-time & scrap rate baseline

- Tool-life target & cost-per-part ceiling

- Coolant/MQL & chip evacuation constraints

- Local stock, lead times, & regrind/recoat service SLAs

Where Autobits Lab CNC Machine Monitoring quietly pays for itself

If you’re A/B-testing cutters (say, Inconel high-feed vs conventional finishing), the fastest gains come from instrumenting your trials:

- Real-time spindle load & vibration trends expose chatter or rubbing so you can optimize feeds/speeds per insert grade and holder.

- Automatic cycle-time & OEE capture lets you compare brand A vs brand B on cost-per-part, not anecdotes.

- Downtime reason codes + tool-change timestamps quantify which tool families really reduce stoppages.

- Predictive alerts flag abnormal tool wear before scrap accumulates—perfect when testing new ceramics or thread mills.

If you’re evaluating cutting tool vendors this quarter, plug Autobits Lab into your CNCs first; run structured trials for two weeks; and let the data pick the winner. (Ask the Autobits team for a trial plan template mapping to the matrix above.)

P.S. Avoid the “we think it ran better” debates in production meetings—because you’ll have the charts.

Conclusion

The 2025 cutting-tool landscape is intensely competitive and increasingly competent: superhard materials + digital insights. Full-line providers (Sandvik, Kennametal, Iscar/IMC, Walter, Seco, Mitsubishi, Sumitomo, Kyocera, Dormer Pramet, OSG, MAPAL, Gühring, YG-1, TaeguTec, Ingersoll, CERATIZIT) give broad coverage and global support; specialists (Vargus, DIJET, Horn, Union Tool) deliver outsized performance in niche operations. Use the decision matrix + monitoring to align the right brand to each constraint—then scale what the data proves.

FAQs

What are the best cutting tools for hard turning 60 HRC bearing steel?

Look at CBN grades from NTK and Sumitomo, validate nose radius/chamfer and edge prep for your hardness range, and monitor spindle load with machine-monitoring to confirm stable wear land formation. (niterragroup.com)

Thread milling vs. thread turning: when should I choose each?

Thread milling offers lower cutting forces and is safer for thin-walled parts and interrupted cuts; thread turning is faster on rigid setups and large diameters. For complex standards, Vargus VARDEX libraries and GENius CNC code can reduce setup time.

Who makes the most precise small-diameter internal grooving tools?

Paul Horn (Supermini®) is a safe shortlist option; they also turn specials quickly for tricky bores.

What’s a good high-feed milling brand for tool steel molds?

DIJET and Ingersoll both field-proven high-feed indexable platforms; compare insert geometry for your hardness and chip-thinning strategy.

I need a tool holding that improves runout and surface finish.

Consider BIG DAISHOWA hydraulic chucks/HSK/BT/CAT holders; pair with balanced assemblies at your spindle speeds.

Which brands excel at precision holemaking/boring?

Walter/KOMET and MAPAL are long-standing references for boring heads and high-accuracy reaming. Sandvik Groupmapal.com.

Who leads in PCB micro drills and ultra-small end mills?

Union Tool is a top OEM reference for high-layer count PCB shops and fine carbide end mills.

Are there full-line brands with strong global support?

Yes, Sandvik Coromant, Kennametal, Seco, Kyocera, Iscar/IMC, CERATIZIT. Verify local tech centers and inventory.

How do I compare cutting tools fairly across brands?

Control all variables (holder, stick-out, coolant, program), run the same part family, log tool-life, cycle time, and scrap automatically via Autobits Lab, then compute cost-per-good-part.