Machine tools are the backbone of modern manufacturing. They shape, cut, grind, drill, and finish raw materials into precise components for automotive, aerospace, energy, electronics, and medical devices. Unlike cutting tools (such as drills, inserts, or end mills), which perform the actual cutting, machine tools are the sophisticated machines that hold, move, and operate these cutting tools.

With automation, Industry 4.0, and precision engineering becoming standard, machine tools are no longer just about metal cutting; they are evolving into intelligent, connected systems that drive productivity and efficiency. This blog provides a comprehensive guide to global machine tool manufacturers, their specialties, market dynamics, and the future of this industry.

Global Machine Tool Market Overview

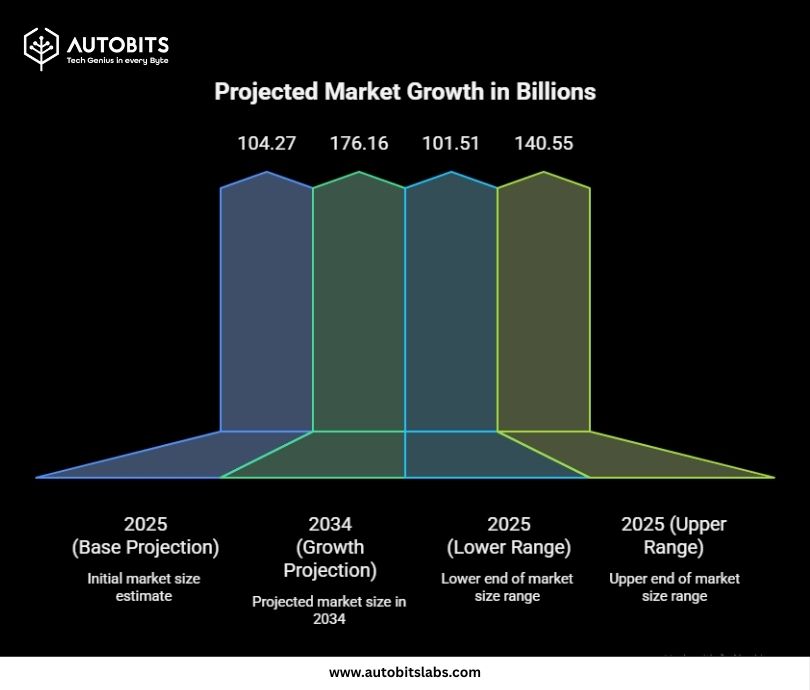

The global machine tool market is robust and rapidly evolving:

- Market Size: Estimated at $104.27 billion in 2025, projected to grow to $176.16 billion by 2034, with a CAGR of around 6%. Other forecasts range between $101.51 billion and $140.55 billion for 2025, depending on the scope of definitions. (Source)

- Regional Insights:

- Due to rapid industrialization and modernization, the Asia Pacific leads the market (over 50% of global sales), driven by China, Japan, and India. (Source)

- North America is expected to grow fastest, fueled by EV manufacturing and advanced aerospace technologies. (Source)

- Europe remains strong, focusing on precision engineering and sustainability.

- Technology Trends:

- CNC machines dominate (80%+ of sales) because of their precision and automation capabilities.

- Industry 4.0, IoT, robotics, and AI integration transform factories into smart manufacturing hubs.

- Key Segments:

- Automotive → most extensive application (~40% of revenue).

- Aerospace, machinery, and electronics are fast-growing areas.

- Product Types: machining centers (especially 5-axis), lathes, grinders, drills, and shearing machines.

- Growth Drivers:

- Expanding manufacturing industries worldwide.

- Advances in multi-axis & multifunctional machines.

- Demand for custom-built, high-precision components.

- Push toward sustainable, energy-efficient operations. (Source)

Leading global manufacturers include: DMG MORI, Mazak, Okuma, Makino, Haas, Amada, Chiron, GF Machining Solutions, Hyundai Wia, and DN Solutions.

Top Machine Tool Manufacturers (By Country)

Machine Tool Manufacturers In Japan

Japan is globally recognized for its precision, automation leadership, and robust after-sales support.

- DMG MORI (Germany-Japan joint) → Known for high-end CNC machining centers, turning machines, and Industry 4.0 solutions. They lead in hybrid additive-subtractive machines and digital platforms (CELOS).

- Mazak (Yamazaki Mazak) → Specializes in multi-tasking machines, 5-axis machining, and laser cutting—a global leader in smart factory integration.

- Okuma → Renowned for CNC lathes, grinders, and machining centers. Pioneers in the “Thermo-Friendly Concept” for consistent accuracy.

- Makino → High-performance machining centers for aerospace, die-mold, and precision engineering.

- Toyoda → Strong in grinding machines, machining centers, and automation solutions.

- Brother Industries → Compact, high-speed machining centers; popular for electronics and automotive small components.

- Enshu → Specializes in vertical machining centers and automation lines.

- Niigata Machine Techno → Known for horizontal machining centers and large-scale precision machines.

Machine Tool Manufacturers In Germany / Europe

Germany and Switzerland are global leaders in high-precision, heavy-duty, and advanced machining.

- Trumpf (Germany) → World leader in sheet metal processing, lasers, and additive manufacturing.

- Heller (Germany) → Specializes in 4/5-axis machining centers and flexible manufacturing systems.

- Chiron Group (Germany) → High-speed machining centers, especially for medical, automotive, and aerospace industries.

- Hermle (Germany) → Precision 5-axis machining centers, widely used in aerospace and toolmaking.

- EMAG (Germany) → Focuses on turning machines, gear machining, and grinding.

- Index-Werke (Germany) → Known for multi-spindle CNC turning machines.

- Starrag Group (Switzerland) → High-end machining for aerospace, energy, and transport sectors.

- GF Machining Solutions (Switzerland) → Leader in EDM (Electrical Discharge Machining), laser texturing, and high-speed milling.

Machine Tool Manufacturers In the USA

The U.S. market emphasizes productivity, affordability, and user-friendly CNC systems.

- Haas Automation → Known for affordable, easy-to-use CNC machining centers and lathes; widely adopted in SMEs.

- Hardinge → Specializes in precision lathes, grinders, and high-end machining solutions.

- Hurco → Focuses on user-friendly CNC controls and multi-axis machining.

- Cincinnati Machine (Fives Group) → Strong in aerospace and large-scale machining solutions.

- Fadal Engineering → Known for vertical machining centers, historically popular in job shops.

Machine Tool Manufacturers In South Korea / Taiwan / China

Asia outside Japan is growing rapidly, driven by cost competitiveness and improving precision standards.

- Doosan Machine Tools (DN Solutions, South Korea) → Major global CNC lathes and machining centers player.

- Hyundai WIA (South Korea) → Produces machining centers, lathes, and automotive-focused CNC solutions.

- Samsung Machine Tools (South Korea) → Offers turning and machining centers for mass production.

- SMEC (South Korea) → Known for precision CNC machines with strong automotive applications.

- Tongtai Machine & Tool (Taiwan) → Offers machining centers, turning, and aerospace machining solutions.

- Fair Friend Group (FFG, Taiwan) → One of the world’s largest machine tool conglomerates (includes Feeler, Leadwell, Jobs).

- Goodway Machine Corp. (Taiwan) → Strong in turning machines and CNC lathes.

- JTEKT (Toyoda Machine Works, Japan origin but global) → Known for grinding and precision machines.

Categories of Machine Tools

Machine tools can be segmented based on their applications and core technologies:

- CNC Machining Centers (Milling/Turning) → DMG MORI, Haas, Mazak, Okuma

- Grinding Machines → Studer (Switzerland), Kellenberger (Switzerland), Okamoto (Japan)

- Sheet Metal & Laser Cutting Machines → Trumpf (Germany), Amada (Japan), Bystronic (Switzerland)

- EDM (Electrical Discharge Machines) → Makino (Japan), GF Machining Solutions (Switzerland), Sodick (Japan)

- Gear & Special Machines → Gleason (USA), Klingelnberg (Germany), Liebherr (Germany)

Comparison Tables

Top Machine Tool Manufacturers by Country

| Country/Region | Leading Companies |

| Japan | DMG MORI, Mazak, Okuma, Makino, Brother |

| Germany/Europe | Trumpf, Hermle, Chiron, Heller, GF Machining |

| USA | Haas, Hardinge, Hurco, Cincinnati Machine |

| South Korea | DN Solutions, Hyundai WIA, Samsung Machine |

| Taiwan | FFG, Tongtai, Goodway |

| Switzerland | GF Machining, Starrag, Studer, Kellenberger |

Top Machine Tool Manufacturers by Machine Type

| Machine Type | Leading Brands |

| CNC Machining Centers | DMG MORI, Mazak, Haas, Okuma |

| Grinding Machines | Studer, Okamoto, Toyoda |

| Sheet Metal/Laser Cutting | Trumpf, Amada, Bystronic |

| EDM Machines | GF Machining, Sodick, Makino |

| Gear & Special Machines | Gleason, Klingelnberg, Liebherr |

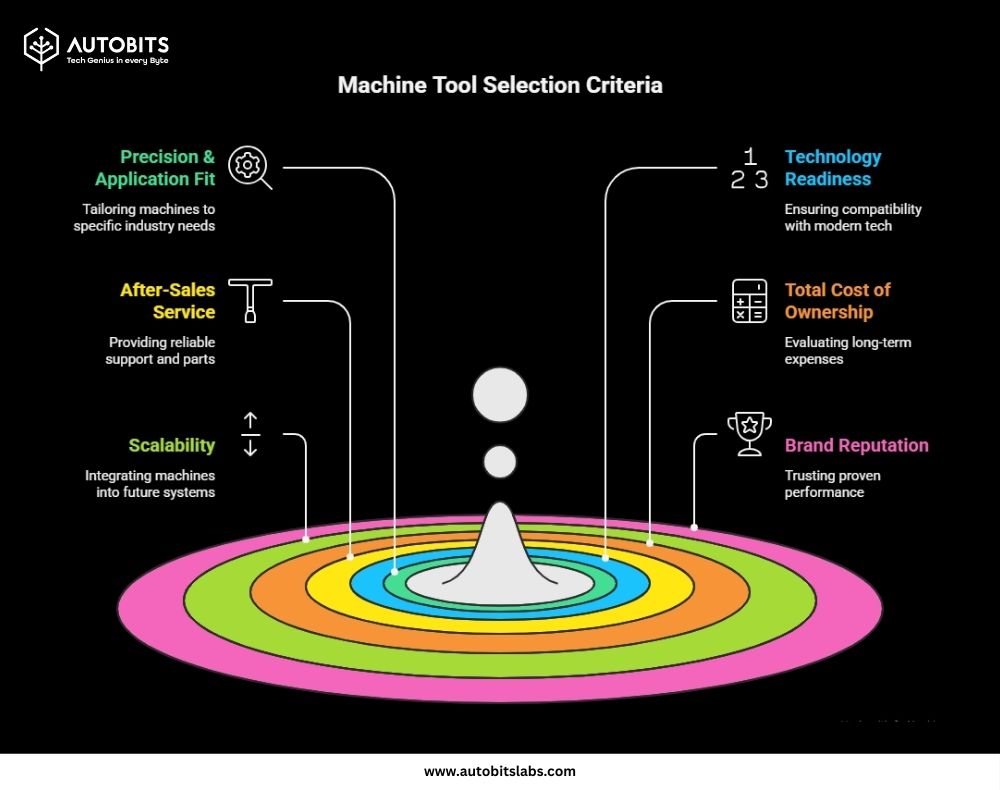

How to Choose a Machine Tool Manufacturer

Choosing the right machine tool partner depends on several factors:

- Precision & Application Fit → Aerospace requires ultra-precision; automotive favors high-volume machining.

- Technology Readiness → Industry 4.0 compatibility, IoT integration, and automation readiness.

- After-Sales Service → Local support and spare parts availability.

- Total Cost of Ownership → Consider machine price, maintenance, downtime, and energy costs.

- Scalability → Machines that can integrate into future smart factories.

- Brand Reputation → Proven performance and global trust.

Future of the Machine Tool Industry

The machine tool industry is entering a transformative era, shaped by digitalization, automation, and sustainability:

- Market Size & Growth → Projected to exceed $137 billion by 2030, growing at a 5–7% CAGR.

- Industry 4.0 Integration → Smart, networked machines with IoT, AI, predictive maintenance, and digital twin technology.

- Automation & Multifunctionality → Multi-axis, hybrid (additive + subtractive), and robotic integration reduce labor dependency.

- Precision & New Applications → EV, aerospace, semiconductors, and medical devices demand ultra-precision machining.

- Sustainability → Energy-efficient designs and green manufacturing practices will be essential.

- Regional Growth → Asia leads (China, Japan, India), while North America & Europe invest heavily in aerospace and EV sectors.

- Technological Leaps →

- AI-enhanced toolpath optimization

- Digital twin simulation

- Closed-loop machining

- Hybrid machining centers

- Cloud-based CNC management

- Advanced tooling for composites & alloys

The future is shifting from traditional “metal cutting” to fully digitized, flexible manufacturing ecosystems.

Conclusion

Machine tools are the foundation of modern industry. From Japanese precision to German engineering and American affordability, manufacturers across the globe are pushing the boundaries of technology. With Industry 4.0, automation, and sustainability reshaping the sector, companies that embrace smart, connected, and multifunctional machine tools will lead the manufacturing landscape of tomorrow.

Want to make your CNC machines smarter? Autobits Labs helps factories connect, monitor, and optimize machine tools in real-time, ensuring higher productivity and lower downtime.

FAQs

What is the No.1 machine tool manufacturer in the world?

Currently, DMG MORI, Mazak, and Trumpf are considered global leaders, depending on the machine category.

Which country leads in machine tool manufacturing?

Japan and Germany are traditional leaders, but China is rapidly expanding its market share.

What is the difference between machine tools and cutting tools?

Machine tools are machines (e.g., CNC machining centers, lathes), while cutting tools are inserts, drills, or end mills used in those machines.

Which is better: Haas vs Mazak vs DMG MORI?

- Haas → Affordable, great for SMEs.

- Mazak → Advanced multi-tasking and automation-ready.

- DMG MORI → Premium, high-precision, and innovation-driven.

Are Chinese CNC machines reliable?

Chinese machines are improving rapidly in cost-effectiveness and precision, but may lag in high-end aerospace/medical applications compared to Japanese and German machines..